lhdn stamp duty rate

Scroll down to see a sample calculation. Transferor Transferee Exemption Rate.

Generally the legal fees and stamp duty depend on the value or selling price of the property being purchased.

. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without any personal reliefsdeductions and rebates. If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250. In contrast pursuant to the Stamp Duty Exemption No.

Can the ASNB branch stamp the date on stamp duty which has not been cancelled by the Commissioner of Oaths in Part C of the T1 Form. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Sukacita dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia HASiL akan menganjurkan Seminar Percukaian Kebangsaan SPK 2022 secara dalam talian webinar.

Only tax resident individual entitles for progressive tax rates personal reliefdeductions and rebates. For more information on how these fees are calculated check out 2022 Stamp duty legal fees and 5 other costs when buying a house in Malaysia. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

Why is there a delay in the issuance of a strata title. 10 Order 2007 the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows. In fact the highest stamp duty exemption claim is for house.

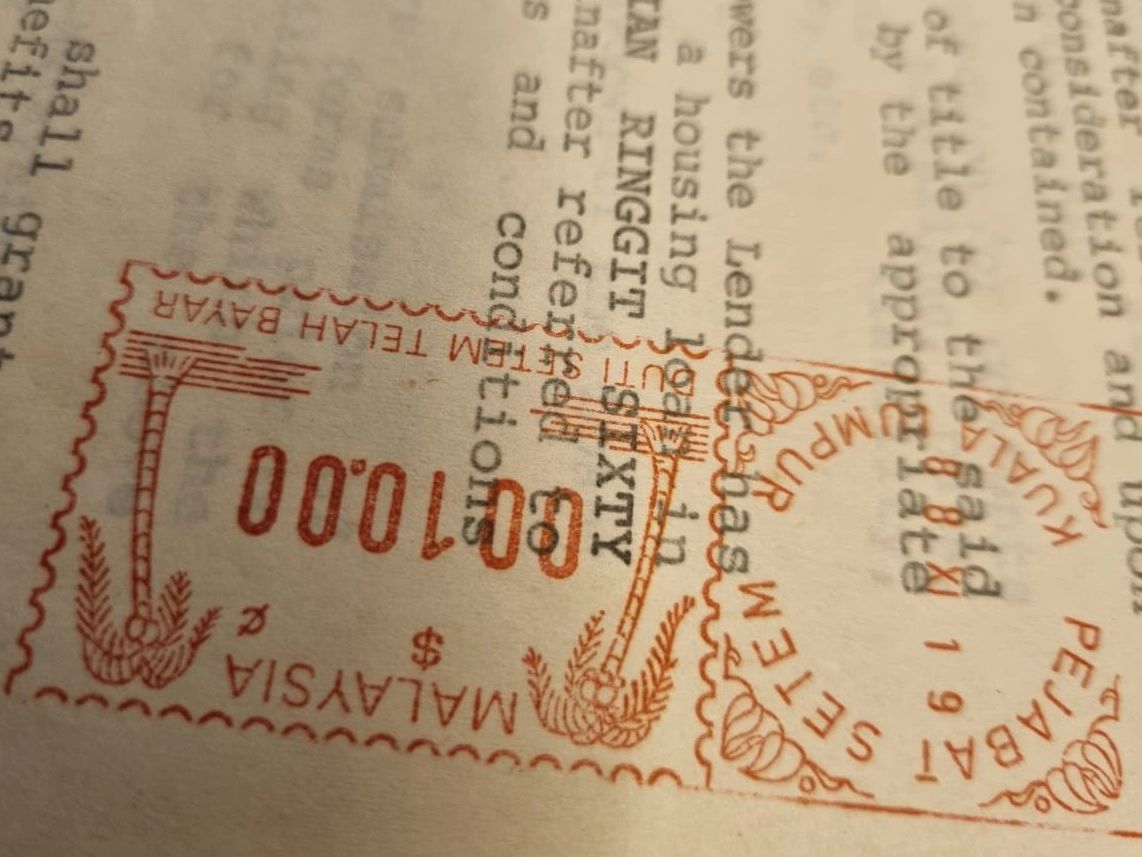

Only the Commissioner of Oaths and the Inland Revenue Office LHDN can put a stamp on the stamp duty column. The law does provide for a stamp duty exemption for a transfer of property by way of love and affection. According to the Inland Revenue Board LHDN the stamp duty exemption claim under the Home Ownership Campaign HOC is RM9578mil.

PENDAFTARAN SEMINAR PERCUKAIAN KEBANGSAAN SPK 2022 TELAH DIBUKA. The 12-month FD rate is more appropriate from unit holders perspective since the 3-month. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

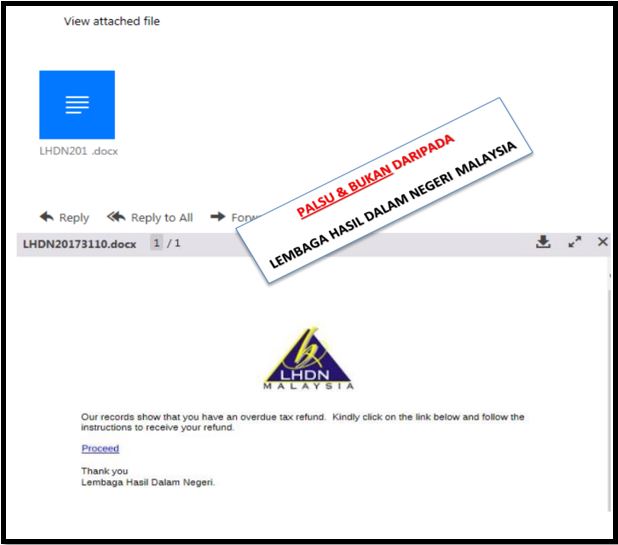

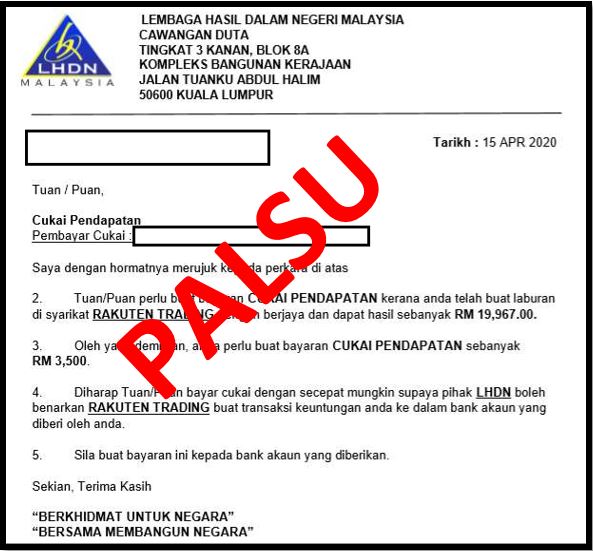

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

Stamping A Contract Is An Unstamped Contract Valid

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Details Of 2 Agent Commission Withholding Tax L Co

Personal Tax Relief 2021 L Co Accountants

Do You Need To Declare Your Rental Income To Lhdn

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Lhdn Updates Stamp Duty Exemptions

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Lhdn Application Stamping Fees For Individual Documents Can Be Made Via Stamps From April 27 The Star

Stamp Duty And Contracts Yee Partners

Stamp Duty And Contracts Yee Partners

Download Lembaga Hasil Dalam Negeri

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

No comments for "lhdn stamp duty rate"

Post a Comment